Investing 101: The Simple Path to Wealth in 2026

- Monkey Budget Editorial Team

- Jan 2

- 2 min read

Updated: 3 days ago

Building a portfolio doesn’t have to be a full-time job. Whether you’re a beginner or a seasoned saver, long-term investing success usually comes down to three things: your strategy, your method, and your mix. Get those right, and the rest tends to take care of itself.

The Strategy: Active vs. Passive

Before you buy your first share, you need to pick your lane.

Active Investing

Active investing is about trying to beat the market — picking individual stocks, rotating sectors, or timing entries and exits. While it can be rewarding, it’s time-consuming, emotionally demanding, and difficult to execute consistently. Even professional fund managers struggle to outperform market averages over long periods.

Passive Investing

Passive investing aims to be the market. You invest in low-cost index funds or ETFs that track broad benchmarks like the S&P 500 or the total stock market. This approach prioritizes diversification, low fees, and long-term compounding.

For roughly 90% of investors, passive investing wins over the long term. After fees, taxes, and mistakes, even the pros have a hard time beating broad indexes over time. Lower costs and consistency matter more than chasing winners.

The Method: Dollar-Cost Averaging

“Market timing” sounds appealing, but in practice it’s a loser’s game. A more reliable approach is Dollar-Cost Averaging (DCA).

DCA means investing a fixed amount of money at regular intervals — for example, $500 every month — regardless of what the market is doing. When prices are high, you buy fewer shares. When prices are low, you buy more shares.

The benefit isn’t higher returns overnight — it’s discipline. DCA removes the pressure of picking the “perfect” moment and helps you stay invested through market ups and downs. It doesn’t eliminate losses, but it greatly reduces the risk of emotional, poorly timed decisions.

The Mix: Your 2026 Portfolio

Your asset allocation — how you divide money among stocks, bonds, and other assets — is one of the biggest drivers of long-term returns and risk.

Find Your Starting Point. A simple guideline many investors use is the “110 minus age” rule:

This isn’t a rule — it’s a reference point. In today’s market, diversification goes beyond just US stocks.

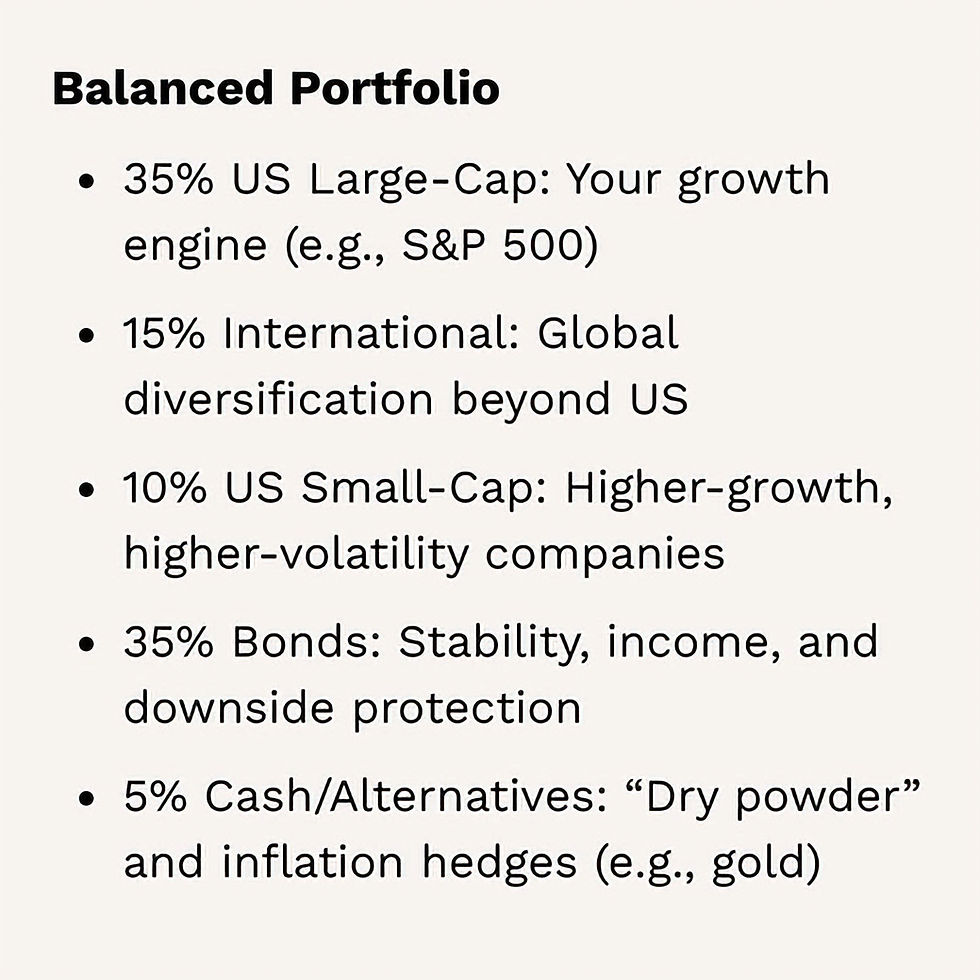

Here’s an example of a balanced, moderate portfolio structure for 2026:

These percentages are starting points — not mandates. Your age, goals, and risk tolerance matter more than any exact number. The Optional “Fun Bucket” Some investors set aside a small fun bucket, typically 5% or less of their portfolio, for individual stocks or higher-risk ideas. Even here, dollar-cost averaging helps. Spreading purchases over time lowers the risk of putting everything in at the wrong moment. The Bottom Line Go passive: Low-cost index funds should be your foundation. Automate: Use dollar-cost averaging to stay consistent. Diversify: Don’t concentrate all your risk in one market or sector. Match: If your company offers a 401(k) match program, make sure you're participating — it's literally free money. And if you don’t have a 401(k) set up, stop what you're doing right now and start immediately. The best time to start investing was yesterday. The second-best time is today. Consistency beats cleverness — every time.