Why Budgeting Feels So Hard — And How to Fix the 5 Biggest Obstacles

- Monkey Budget Editorial Team

- 2 days ago

- 4 min read

Updated: 2 days ago

Ever set up a budget, felt motivated for a few weeks...then watched it fall apart?

That’s not a willpower problem. It’s a system problem.

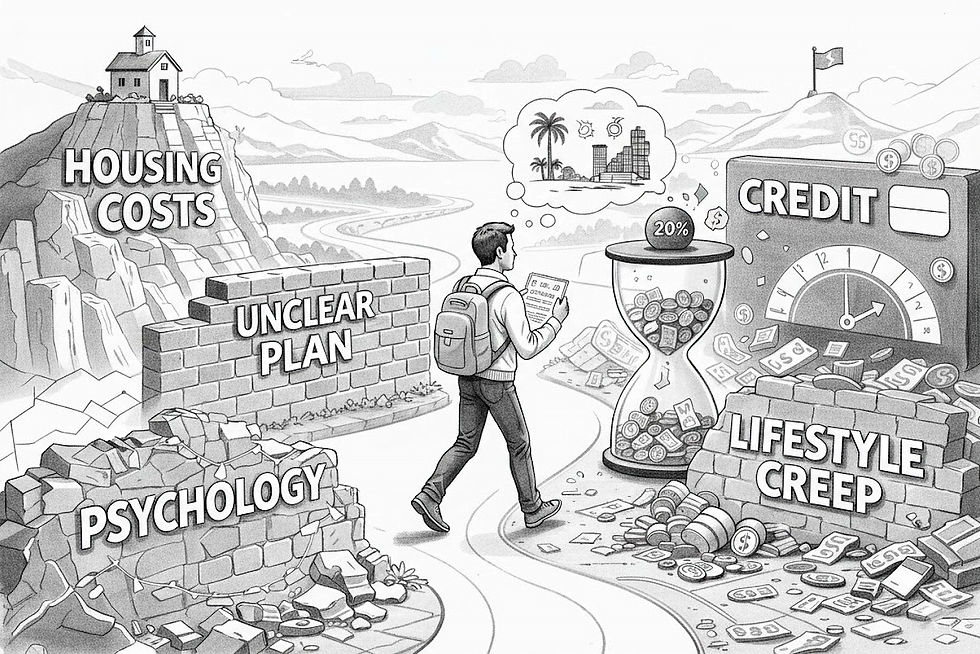

If budgeting feels impossible, frustrating, or like a cycle you can’t stick to, you’re not broken — your system is. Most people think budgeting fails because of a lack of discipline. In reality, it breaks down when big structural costs, poor planning, psychology, and credit habits work against you. Fix those, and managing money suddenly feels much more doable.

Here are five common reasons budgeting feels so hard — and what to do about each one.

1. Housing Costs Are Eating Your Budget

Housing is one of the biggest drains on any budget — and it’s not optional. Unfortunately, rent and mortgage costs have risen much faster than incomes.

These structural forces are already working against you, but you still have to make smart housing decisions. According to the U.S. Census, more than half of households are rent-burdened, meaning they spend over 30% of their income on rent and utilities.

If rent or your mortgage is swallowing 30%, 40%, or even 50%+ of your income, budgeting turns into damage control. There’s only so much you can cut from groceries, subscriptions, and takeout before the math just stops working.

The solution: Aim to keep housing near 25–30% of take-home pay when possible. If you’re above that range, budgeting alone won’t solve the pressure. Roommates, refinancing, moving when a lease ends, or increasing income may be the real solution. You can’t out-budget bad math.

Search hard for good deals — like any market, there are outliers. Reducing rent by even 10–20% is a huge win. Homeowners have less flexibility, but refinancing or downsizing later can still change the equation.

2. You Built a Budget… But Not a Plan

Having a game plan is crucial. Like a coach preparing for a big game, budgeting requires thought and preparation before things begin — not just reacting as expenses happen.

At first, it needs to be managed week to week, then month to month. Eventually, it becomes second nature — but only if you start with a solid foundation.

A lot of budgets are just lists of “don’ts.” Don’t eat out. Don’t shop. Don’t spend. That feels like punishment, not a plan.

The solution: Turn your budget into a spending plan. Assign money to categories that support your life and goals — bills, savings, fun, and flexibility. When your money has a purpose, spending feels intentional instead of guilty. Also create a safety-net category for the unexpected expenses that always pop up.

3. Your Present Self Is Fighting Your Future Self

Part of a good game plan is clearly mapping your budget to your goals. Whether it’s a short-term goal like taking a trip or a long-term goal like a home down payment, those goals need to be built into your plan.

Otherwise, they stay as ideas — not priorities. When your budget lacks purpose, it’s easy to spend on things that don’t matter as much. Your brain naturally favors immediate rewards.

The solution: Make future goals feel real. Name savings accounts (“Emergency Fund,” “House Down Payment,” “Travel Fund”), set clear targets, and track progress. When your future has a face, it’s easier to prioritize it.

4. Lifestyle Creep Quietly Breaks Your System

This affects people at every income level. As income rises, expenses tend to rise too — nicer places, better cars, more convenience. Over time, you make more but don’t feel ahead.

Many people end up with a fully “leveraged” lifestyle, where nearly every dollar already has somewhere to go. There’s also the pressure to keep up with peers. It’s tough to ignore, but if you can shift your focus toward banking raises and extra income, you create real financial breathing room.

The solution: Decide in advance where raises and bonuses go. Don’t automatically spend the increase. Many people commit to sending 30–50% of any pay bump straight to savings or investing. Some save even more. Upgrade your life intentionally — not automatically.

5. Credit Turns Tomorrow’s Money Into Today’s Problem

Credit cards can make budgets feel easier in the moment because they cover gaps. But those gaps don’t disappear — they show up later with interest.

Rewards points don’t help if you’re paying 20–22% interest. That’s a fast track to budget stress.

The solution: Treat credit like delayed cash, not extra income. Track card spending in real time and aim to pay balances in full each month. If debt has built up, create a payoff plan quickly so your money stops working against you. Loans and credit should support long-term goals — not short-term lifestyle.

The Bottom Line

Most people try to fix budgeting with more discipline. The real fix is better design.

Budgeting feels hard when your system is stacked against you. High fixed costs, unclear goals, creeping expenses, and credit use can quietly undo even the best intentions.

But when you align housing costs, build a real plan, make future goals visible, control lifestyle upgrades, and use credit wisely, budgeting stops feeling like constant restriction — and starts feeling like control.

Fix the system, and the habits follow.